5.4 Appendix: Complete a Comprehensive Accounting Cycle for a Business

We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here. The full accounting cycle diagram is presented in Figure 5.14 .

We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. Cliff decides it would be fun to become a barber and open his own shop called “Clip’em Cliff.” He will run the barber shop out of his home for the first couple of months while he identifies a new location for his shop.

Since his Marines career included several years of logistics, he is also going to operate a consulting practice where he will help budding barbers create a barbering practice. He will charge a flat fee or a per hour charge. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice.

He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 5.2 shows his transactions from the first month of business.

Transaction 1: On August 1, 2019, Cliff issues $70,000 shares of common stock for cash.

- Clip’em Cliff now has more cash. Cash is an asset, which is increasing on the debit side.

- When the company issues stock, this yields a higher common stock figure than before issuance. The common stock account is increasing on the credit side.

Transaction 2: On August 3, 2019, Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days.

- Clip’em Cliff now has more equipment than before. Equipment is an asset, which is increasing on the debit side for $45,000.

- Cash is used to pay for $37,500. Cash is an asset, decreasing on the credit side.

- Cliff asked to be billed, which means he did not pay cash immediately for $7,500 of the equipment. Accounts Payable is used to signal this short-term liability. Accounts payable is increasing on the credit side.

Transaction 3: On August 6, 2019, Cliff purchases supplies for $300 cash.

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- Supplies, an asset account, is increasing on the debit side.

Transaction 4: On August 10, 2019, provides $4,000 in services to a customer who asks to be billed for the services.

- Clip’em Cliff provided service, thus earning revenue. Revenue impacts equity, and increases on the credit side.

- The customer did not pay immediately for the service and owes Cliff payment. This is an Accounts Receivable for Cliff. Accounts Receivable is an asset that is increasing on the debit side.

Transaction 5: On August 13, 2019, Cliff pays a $75 utility bill with cash.

- Clip’em Cliff now has less cash than before. Cash is an asset that is decreasing on the credit side.

- Utility payments are billed expenses. Utility Expense negatively impacts equity, and increases on the debit side.

Transaction 6: On August 14, 2019, Cliff receives $3,200 cash in advance from a customer for services to be rendered.

- The customer has not yet received services but already paid the company. This means the company owes the customer the service. This creates a liability to the customer, and revenue cannot yet be recognized. Unearned Revenue is the liability account, which is increasing on the credit side.

Transaction 7: On August 16, 2019, Cliff distributed $150 cash in dividends to stockholders.

- When the company pays out dividends, this decreases equity and increases the dividends account. Dividends increases on the debit side.

Transaction 8: On August 17, 2019, Cliff receives $5,200 cash from a customer for services rendered.

- Clip’em Cliff now has more cash than before. Cash is an asset, which is increasing on the debit side.

- Service was provided, which means revenue can be recognized. Service Revenue increases equity. Service Revenue is increasing on the credit side.

Transaction 9: On August 19, 2019, Cliff paid $2,000 toward the outstanding liability from the August 3 transaction.

- Accounts Payable is a liability account, decreasing on the debit side.

Transaction 10: On August 22, 2019, Cliff paid $4,600 cash in salaries expense to employees.

- When the company pays salaries, this is an expense to the business. Salaries Expense reduces equity by increasing on the debit side.

Transaction 11: On August 28, 2019, the customer from the August 10 transaction pays $1,500 cash toward Cliff’s account.

- The customer made a partial payment on their outstanding account. This reduces Accounts Receivable. Accounts Receivable is an asset account decreasing on the credit side.

- Cash is an asset, increasing on the debit side.

The complete journal for August is presented in Figure 5.15 .

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. The ledger is visually represented by T-accounts. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account.

Clip’em Cliff’s ledger represented by T-accounts is presented in Figure 5.16 .

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure 5.17 .

Once all of the account balances are transferred to the correct columns, each column is totaled. The total in the debit column must match the total in the credit column to remain balanced. The unadjusted trial balance for Clip’em Cliff appears in Figure 5.18 .

The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made.

On August 31, Cliff has the transactions shown in Table 5.3 requiring adjustment.

Adjusting Transaction 1: Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month.

- $250 of supplies remain at the end of August. The company began the month with $300 worth of supplies. Therefore, $50 of supplies were used during the month and must be recorded (300 – 250). Supplies is an asset that is decreasing (credit).

- Supplies is a type of prepaid expense, that when used, becomes an expense. Supplies Expense would increase (debit) for the $50 of supplies used during August.

Adjusting Transaction 2: The equipment purchased on August 3 depreciated $2,500 during the month of August.

- Equipment cost of $2,500 was allocated during August. This depreciation will affect the Accumulated Depreciation–Equipment account and the Depreciation Expense–Equipment account. While we are not doing depreciation calculations here, you will come across more complex calculations, such as depreciation in Long-Term Assets .

- Accumulated Depreciation–Equipment is a contra asset account (contrary to Equipment) and increases (credit) for $2,500.

- Depreciation Expense–Equipment is an expense account that is increasing (debit) for $2,500.

Adjusting Transaction 3: Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction.

- The customer from the August 14 transaction gave the company $3,200 in advanced payment for services. By the end of August the company had earned $1,100 of the advanced payment. This means that the company still has yet to provide $2,100 in services to that customer.

- Since some of the unearned revenue is now earned, Unearned Revenue would decrease. Unearned Revenue is a liability account and decreases on the debit side.

- The company can now recognize the $1,100 as earned revenue. Service Revenue increases (credit) for $1,100.

Adjusting Transaction 4: Reviewing the company bank statement, Clip’em Cliff identifies $350 of interest earned during the month of August that was previously unrecorded.

- Interest is revenue for the company on money kept in a money market account at the bank. The company only sees the bank statement at the end of the month and needs to record as received interest revenue reflected on the bank statement.

- Interest Revenue is a revenue account that increases (credit) for $350.

- Since Clip’em Cliff has yet to collect this interest revenue, it is considered a receivable. Interest Receivable increases (debit) for $350.

Adjusting Transaction 5: Unpaid and previously unrecorded income taxes for the month are $3,400.

- Income taxes are an expense to the business that accumulate during the period but are only paid at predetermined times throughout the year. This period did not require payment but did accumulate income tax.

- Income Tax Expense is an expense account that negatively affects equity. Income Tax Expense increases on the debit side.

- The company owes the tax money but has not yet paid, signaling a liability. Income Tax Payable is a liability that is increasing on the credit side.

The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 5.19 .

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in Figure 5.20 .

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 5.21 .

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance.

The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 5.22 .

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows .

To prepare your financial statements, you want to work with your adjusted trial balance.

Remember, revenues and expenses go on an income statement. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

The income statement for Clip’em Cliff is shown in Figure 5.23 .

Note that expenses were only $25 less than revenues. For the first month of operations, Cliff welcomes any income. Cliff will want to increase income in the next period to show growth for investors and lenders.

Next, Cliff prepares the following statement of retained earnings ( Figure 5.24 ).

The beginning retained earnings balance is zero because Cliff just began operations and does not have a balance to carry over to a future period. The ending retained earnings balance is –$125. You probably never want to have a negative value on your retained earnings statement, but this situation is not totally unusual for an organization in its initial operations. Cliff will want to improve this outcome going forward. It might make sense for Cliff to not pay dividends until he increases his net income.

Cliff then prepares the balance sheet for Clip’em Cliff as shown in Figure 5.25 .

The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. The first entry closes revenue accounts to income summary. To close revenues, Cliff will debit revenue accounts and credit income summary.

The second entry closes expense accounts to income summary. To close expenses, Cliff will credit expense accounts and debit income summary.

The third entry closes income summary to retained earnings. To find the balance, take the difference between the income summary amount in the first and second entries (10,650 – 10,625). To close income summary, Cliff would debit Income Summary and credit Retained Earnings.

The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings.

Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 5.26 .

Now that the temporary accounts are closed, they are ready for accumulation in the next period.

The last step for the month of August is step 9, preparing the post-closing trial balance. The post-closing trial balance should only contain permanent account information. No temporary accounts should appear on this trial balance. Clip’em Cliff’s post-closing trial balance is presented in Figure 5.27 .

At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods.

Concepts In Practice

Reversing entries.

One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice. The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal.

Link to Learning

As we have learned, the current ratio shows how well a company can cover short-term debt with short-term assets. Look through the balance sheet in the 2017 Annual Report for Target and calculate the current ratio. What does the outcome mean for Target ?

Think It Through

Using liquidity ratios to evaluate financial performance.

You own a landscaping business that has just begun operations. You made several expensive equipment purchases in your first month to get your business started. These purchases very much reduced your cash-on-hand, and in turn your liquidity suffered in the following months with a low working capital and current ratio.

Your business is now in its eighth month of operation, and while you are starting to see a growth in sales, you are not seeing a significant change in your working capital or current ratio from the low numbers in your early months. What could you attribute to this stagnancy in liquidity? Is there anything you can do as a business owner to better these liquidity measurements? What will happen if you cannot change your liquidity or it gets worse?

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/5-4-appendix-complete-a-comprehensive-accounting-cycle-for-a-business

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Bookkeeping Basics > Accounting Cycle Steps

Accounting Cycle Steps

Financial accounting cycle.

The accounting cycle is a series of steps setting out the procedures required for a typical small business to collect, record, and process its financial information.

The diagram below shows the ten basic accounting cycle steps. A PDF version of this diagram is available at the bottom of the page.

Accounting Cycle Diagram

To explain the accounting cycle we have set out the ten steps involved in the flow chart diagram below.

Accounting Cycle Steps in Order

Step 1: identify and analyze transactions.

The accounting cycle starts by identifying the transactions which relate to the business. The cycle includes only business transactions as the business is a separate entity to the owner.

Having identified the transactions, each one now needs to be analyzed to determine which accounts in the bookkeeping records are affected. Each transaction must be supported by a relevant accounting source document such as sales and purchases invoices, debit and credit notes, petty cash vouchers, payroll reports etc.

Step 2: Journal Entries for Transactions

The journals are also known as the books of original entry as they are the first time the transactions are recorded and entered into the accounting system.

Step 3: Post journals to ledgers

The journals are used to post to the subsidiary and general ledgers (sometimes referred to as the book of final entry). The general ledger has an account for each type of transaction e.g. rent expense, accounts receivable control, fixed assets etc. The general ledger is sometimes divided into the nominal ledger for income and expenses, and the private ledger for assets and liabilities.

All postings to the ledgers are double entry postings and therefore must balance which every debit having an equal and opposite credit entry.

Step 4: Prepare an unadjusted trial balance

At the end of each accounting period, the balances on the accounts of the general ledger are listed to produce a trial balance . At this stage the total debits on the trial balance should equal the total credits.

It is important to realize that this unadjusted trial balance is used solely to check the total of the debit and credit entries, to ensure the accounting records balance and that the arithmetic is correct. If the trial balance does not balance correcting entries should be made in the ledgers until it does.

Step 5: Prepare worksheet

A 10 column worksheet is prepared and the unadjusted trial balance is transferred to the first two columns.

Step 6: Record adjusting journal entries

Adjusting entries such as accruals, prepayments, and depreciation entries are prepared to ensure that income and expenditure is allocated to the correct accounting period, this means that the accounting records are completed on an accruals basis and are in compliance with the matching principle.The adjusting entries are entered in the next two columns of the worksheet and at this stage, are not entered into the accounting records.

Step 7: Adjusted trial balance

When all adjusting entries have been completed an adjusted trial balance is prepared in the next two columns of the worksheet.

Step 8: Prepare financial statements

The financial statements can now be prepared from the adjusted trial balance. Items relating to the income statement are transferred to the next two columns and items relating to the balance sheet are transferred to the final two columns.

Step 9: Closing entries

Closing entries are carried out in the accounting ledgers. Closing entries are posted and temporary income and expenditure accounts are closed and their balances transferred to an income and expenditure summary account.

The summary account is in turn closed to transfer the profit or loss for the period to the balance sheet retained profits account. Balance sheet or permanent accounts are not closed, but the balance is carried forward to the next accounting period.

Step 10: Post closing trial balance

Finally a post closing trial balance is drawn up to ensure that the debits and credits balance for the start of the new accounting period .

The post closing trial balance is a list of balances after the closing entries have been made. At this stage the temporary income and expenditure accounts have been closed and set to zero, so only the balance sheet accounts are listed on the post closing trial balance. The accounting cycle starts again with the new opening balance sheet account balances.

The accounting cycle diagram is available for download in PDF format by following the link below.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Accounting Worksheet

Home › Accounting › Accounting Cycle › Accounting Worksheet

- What is an Accounting Worksheet?

An accounting worksheet is a tool used to help bookkeepers and accountants complete the accounting cycle and prepare year-end reports like unadjusted trial balances, adjusting journal entries , adjusted trial balances , and financial statements .

The accounting worksheet is essentially a spreadsheet that tracks each step of the accounting cycle. The spreadsheet typically has five sets of columns that start with the unadjusted trial balance accounts and end with the financial statements. In other words, an accounting worksheet is basically a spreadsheet that shows all of the major steps in the accounting cycle side by side.

Each step lists its debits and credits with totals calculated at the bottom. Just like the trial balances, the work sheet also has a heading that consists of the company name, title of the report, and time period the report documents.

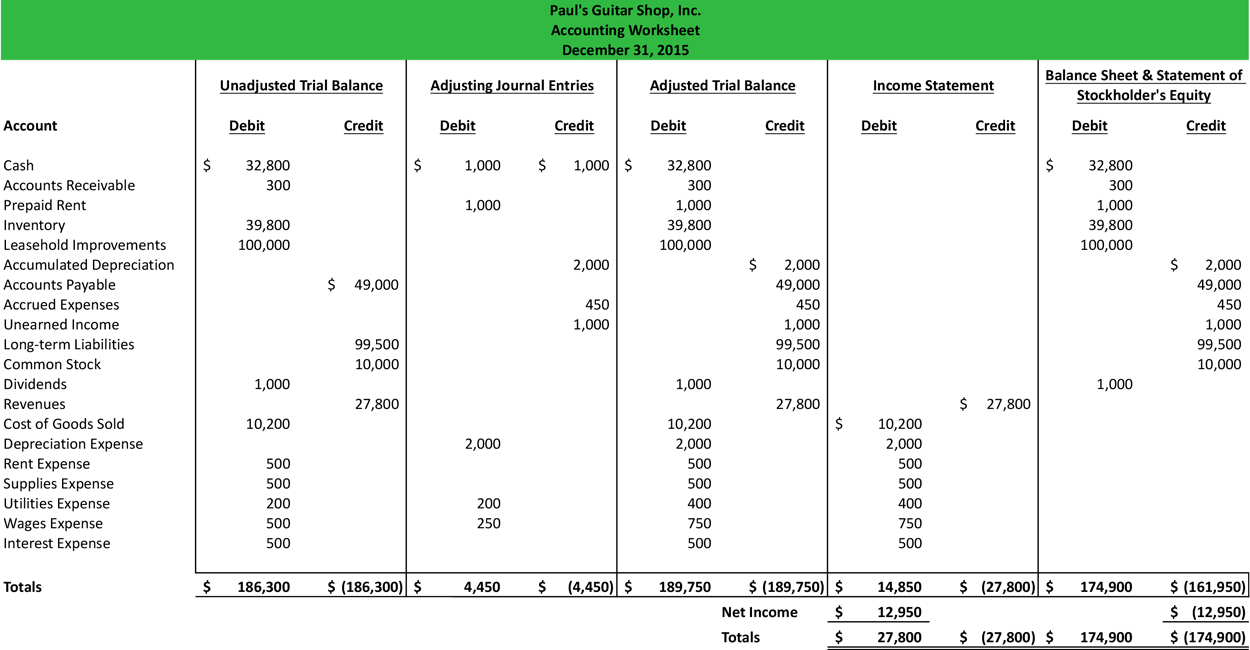

Here is what Paul’s Guitar Shop’s year-end would look like in accounting worksheet format for the accounting cycle examples in this section.

As you can see, the worksheet lists all the trial balances and adjustments side by side. During the accounting cycle process, an accounting worksheet can be helpful to keep track of the different steps and reduce errors.

It can also be used for a analytical and summary tool to show how accounts were originally posted to the ledger and what adjustments were made before they were presented on the financial statements.

I suggest using the accounting worksheet for all your year-end accounting problems. It saves time and maintains accuracy in the process. Here is a downloadable excel version of this accounting worksheet template, so you can use it with your accounting homework.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Journal Entries

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Financial Statement Prep

- Closing Entries

- Income Summary Account

- Post Closing Trial Balance

- Reversing Entries

- Financial Statements

- Financial Ratios

IMAGES

VIDEO

COMMENTS

Accounting Cycle Exercises I 6 Problem 1: Worksheet Problem 1 Juniper Corporation provided the following summary balance sheet information: Dec. 31, 20X8 Dec. 31, 20X9 Total Assets $2,500,000 $3,800,000 Total Liabilities 900,000 1,300,000 Compute net income for the year ending December 31, 20X9, under each of the following independent scenarios:

b. Yes. All companies have an accounting cycle that begins with analyzing and journalizing transactions and ends with a post-closing trial balance. However, companies may differ in how they implement the steps in the accounting cycle. For example, while most companies use computerized accounting systems, some companies may use manual systems. 9.

The accounting cycle generally consists of eight specific steps. In this chapter, we illus-trate how businesses (1) journalize (record) transactions, (2) post each journal entry to the appropriate ledger accounts, and (3) prepare a trial balance. The remaining steps of the cycle will be addressed in Chapters 4 and 5.

The Accounting Cycle 7 Contents Part 4: The Reporting Cycle 18. Preparing Financial Statements 18.1 An Illustration 18.2 Considering the Actual Process for Adjustments 18.3 Financial Statements 18.4 Computerization 18.5 A Worksheet Approach 18.6 An Additional Illustration 19. The Accounting Cycle and Closing Process 19.1 The Closing Process

Why It Matters; 3.1 Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements; 3.2 Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions; 3.3 Define and Describe the Initial Steps in the Accounting Cycle; 3.4 Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business ...

Chpt 4: Completing the Accounting Cycle 1 LO 1 Prepare a worksheet Below is a table demonstrating the basic form of a worksheet and the five steps for preparing it. Each ... Chpt 4: Completing the Accounting Cycle 8 LO 4: Identify the sections of a classified balance sheet. • Describes a company's financial position (types and amounts of ...

142CHAPTER 4 The Accounting Cycle: Reporting Financial Results. The $30 interest expense that accrued in December will appear in Overnight's 2002 income statement. Both the $30 interest payable and the $4,000 note payable to National Bank will appear as liabilities in the December 31, 2002, balance sheet (page 000).

Step 1: Identify and Analyze Transactions. The accounting cycle starts by identifying the transactions which relate to the business. The cycle includes only business transactions as the business is a separate entity to the owner. Having identified the transactions, each one now needs to be analyzed to determine which accounts in the bookkeeping ...

The accounting cycle is the holistic process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements, to closing the accounts. ... #5 Worksheet. Worksheet: When the debits and credits on the trial balance don't match, the bookkeeper must look for ...

Accounting Cycle Steps: Accounting cycle is an accounting procedure starting from recording of business transactions and ends in final preparation of financial statements for reporting. It is a step by step process of accounts collecting, recording, maintaining and reporting. A book keeper of company track all the process of accounting from the ...

Format. The accounting worksheet is essentially a spreadsheet that tracks each step of the accounting cycle. The spreadsheet typically has five sets of columns that start with the unadjusted trial balance accounts and end with the financial statements. In other words, an accounting worksheet is basically a spreadsheet that shows all of the major steps in the accounting cycle side by side.

Accounting cycle optional steps. The accounting cycle also includes two additional optional steps. As you may already be aware, businesses might use a worksheet when creating adjusting entries and financial statements. They can also use reversing entries, which are covered in more detail below. 1. Worksheet:

Step 5: A worksheet was completed. Step 6: Financial statements were prepared. This chapter covers the following steps, which will complete Clark's accounting cycle for the month of May: Step 7: Journalizing and posting adjusting entries Step 8: Journalizing and posting closing entries Step 9: Preparing a post-closing trial balance

Learning Unit 4-3: The Financial Statements from the Worksheet (Step 6 of the Accounting Cycle) 117 Preparing the Income Statement 117 Preparing the Statement of Owner's Equity 120 Preparing the Balance Sheet 120 Demonstration Summary Problem 123 • Success Coach 127 • Blueprint of Steps 5 and 6 of the Accounting Cycle 128 • Discussion ...

Accounting Cycle Exercises IV 18 Problem 3: Worksheet Worksheet 3 (a) GENERAL JOURNAL Date Accounts Debit Credit Dec. 31 To close the revenue account to Income Summary Dec. 31 To close the expense accounts to Income Summary Dec. 31 To close Income Summary to retained earnings Dec. 31 To close dividends Worksheet 3 (b) CASH DIVIDENDS closing

THE ACCOUNTING CYCLE COMPLETED 173 LEARNING UNIT 5-1 REVIEW AT THIS POINTyou should be able to: Define and state the purpose of adjusting entries.(p. 170) Journalize adjusting entries from the worksheet.(p. 171) Post journalized adjusting entries to the ledger.(p. 171) Compare specific ledger accounts before and after posting of the journalized

Accounting 300A-10A The Operating Cycle: Worksheet/Closing Entries Page 4 a. before an entry is recorded in a journal. b. when the entry is posted to the ledger. c. when the trial balance is prepared. d. at some other point in the accounting cycle. *7. Under the cash basis of accounting, revenues are recorded a. when they are earned and realized.

The ACCounTing CyCle: AdjusTmenTs Assessment Questions As-1 (7) What is the purpose of a worksheet? The worksheet is optional, but it can be used to see the impact of the adjustments to the account balances before creating the journal entries and posting to the general ledger. As-2 (1) Why must adjustments be made at the end of the accounting ...

The Accounting Cycle 7 Contents Part 4: The Reporting Cycle 18. Preparing Financial Statements 18.1 An Illustration 18.2 Considering the Actual Process for Adjustments 18.3 Financial Statements 18.4 Computerization 18.5 A Worksheet Approach 18.6 An Additional Illustration 19. The Accounting Cycle and Closing Process 19.1 The Closing Process

Adjusted Trial Balance. Preparation of Financial Statements. Closing Entry. Post-Closing Trial Balance. Reversing Entry. 1. Identification of Transaction. The 1st step of the accounting cycle is the identification of transactions. Transactions are identified after analyzing all events.

or longer, if the operating cycle is greater Current assetsCash and equivalents, accounts receivable, inventory, prepaid expenses to be used within a year Long-term assets Expected benefit greater than one year Examples: property, plant, equipment, intangible assets (copyrights, trademarks, goodwill)