How to Create a Cash Flow Forecast

10 min. read

Updated October 27, 2023

A good cash flow forecast might be the most important single piece of a business plan . All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills.

That’s what a cash flow forecast is about—predicting your money needs in advance.

By cash, we mean money you can spend. Cash includes your checking account, savings, and liquid securities like money market funds. It is not just coins and bills.

Profits aren’t the same as cash

Profitable companies can run out of cash if they don’t know their numbers and manage their cash as well as their profits.

For example, your business can spend money that does not show up as an expense on your profit and loss statement . Normal expenses reduce your profitability. But, certain spending, such as spending on inventory, debt repayment, new equipment, and purchasing assets reduces your cash but does not reduce your profitability. Because of this, your business can spend money and still look profitable.

On the sales side of things, your business can make a sale to a customer and send out an invoice, but not get paid right away. That sale adds to the revenue in your profit and loss statement but doesn’t show up in your bank account until the customer pays you.

That’s why a cash flow forecast is so important. It helps you predict how much money you’ll have in the bank at the end of every month, regardless of how profitable your business is.

Learn more about the differences between cash and profits .

- Two ways to create a cash flow forecast

There are several legitimate ways to do a cash flow forecast. The first method is called the “Direct Method” and the second is called the “Indirect Method.” Both methods are accurate and valid – you can choose the method that works best for you and is easiest for you to understand.

Unfortunately, experts can be annoying. Sometimes it seems like as soon as you use one method, somebody who is supposed to know business financials tells you you’ve done it wrong. Often that means that the expert doesn’t know enough to realize there is more than one way to do it.

- The direct method for forecasting cash flow

The direct method for forecasting cash flow is less popular than the indirect method but it can be much easier to use.

The reason it’s less popular is that it can’t be easily created using standard reports from your business’s accounting software. But, if you’re creating a forecast – looking forward into the future – you aren’t relying on reports from your accounting system so it may be a better choice for you.

That downside of choosing the direct method is that some bankers, accountants, and investors may prefer to see the indirect method of a cash flow forecast. Don’t worry, though, the direct method is just as accurate. After we explain the direct method, we’ll explain the indirect method as well.

The direct method of forecasting cash flow relies on this simple overall formula:

Cash Flow = Cash Received – Cash Spent

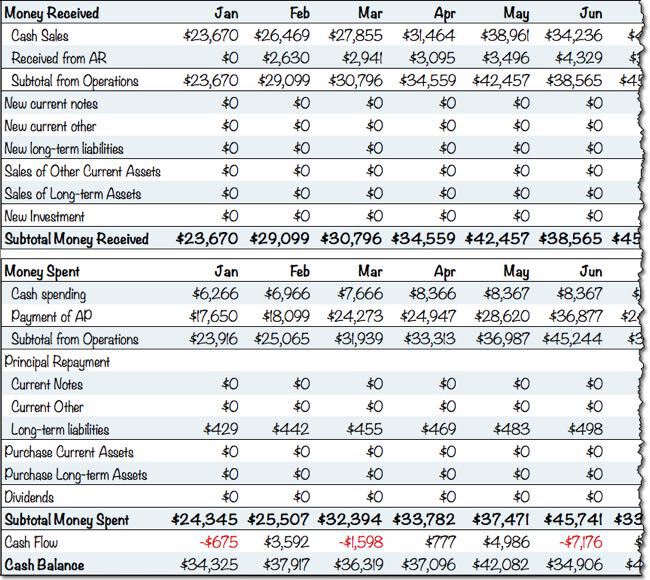

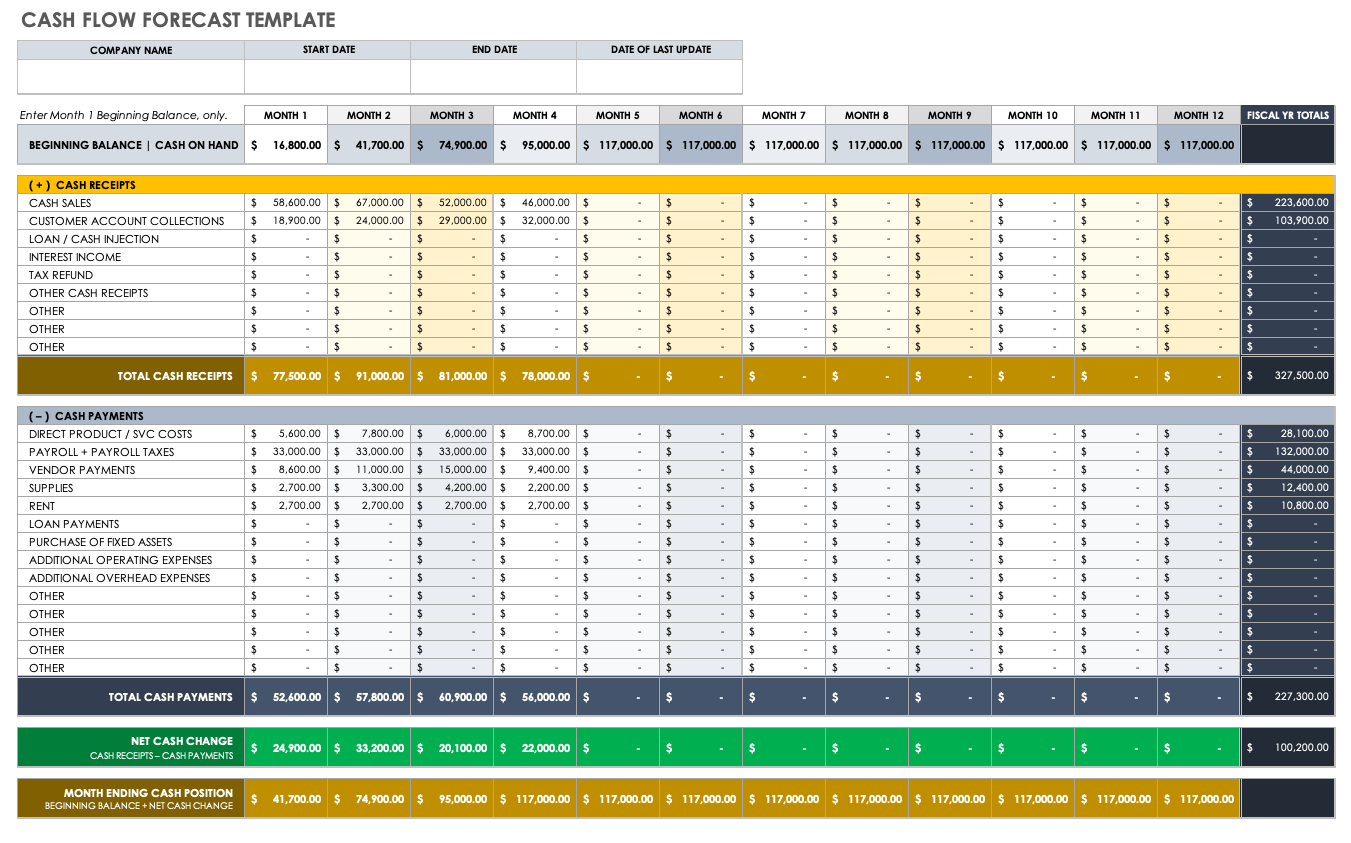

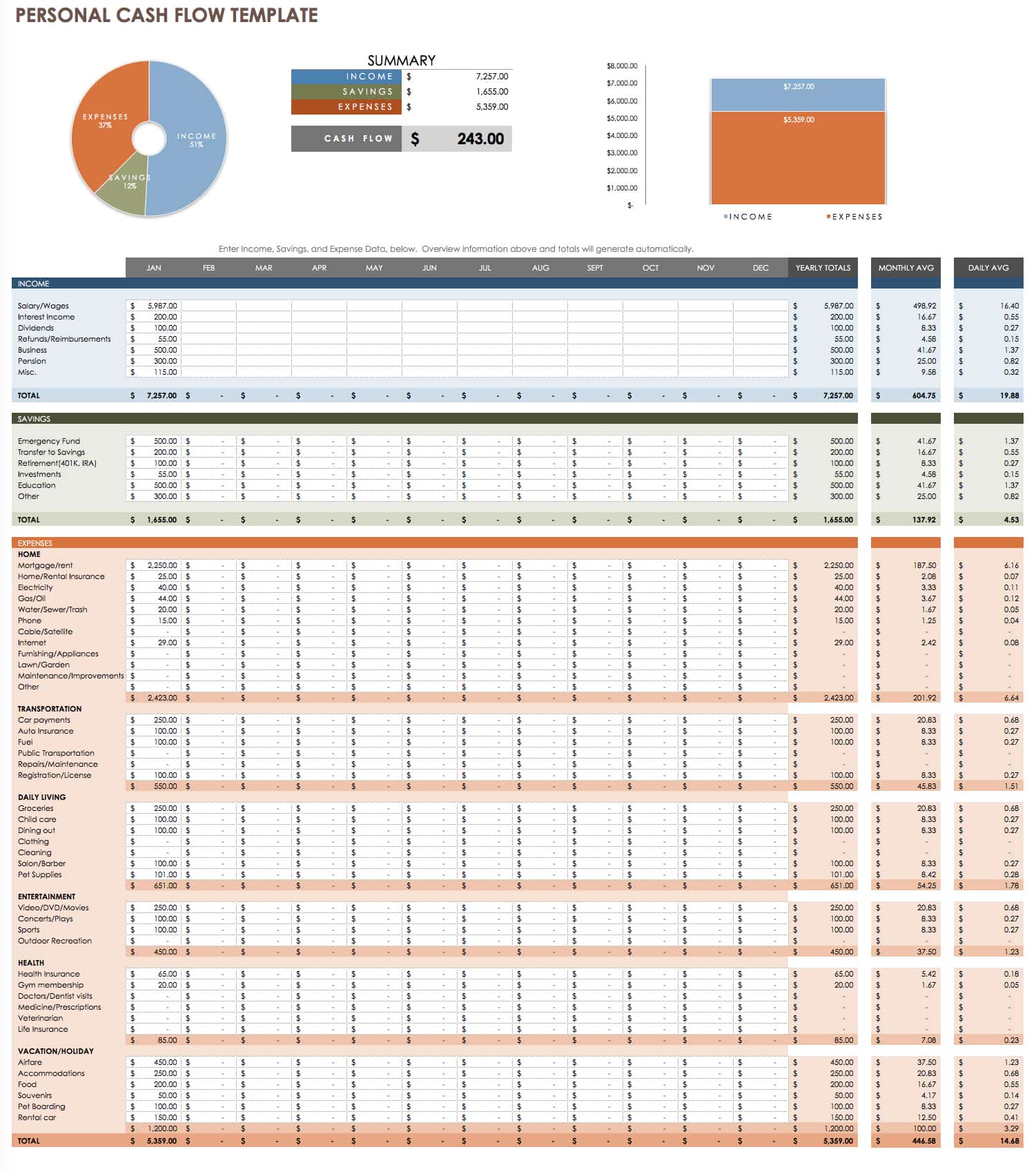

And here’s what that cash flow forecast actually looks like:

Let’s start by estimating your cash received and then we’ll move on to the other sections of the cash flow forecast.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Forecasting cash received

You receive cash from four primary sources:

1. Sales of your products and services

In your cash flow forecast, this is the “Cash from Operations” section. When you sell your products and services, some customers will pay you immediately in cash – that’s the “cash sales” row in your spreadsheet. You get that money right away and can deposit it in your bank account. You might also send invoices to customers and then have to collect payment. When you do that, you keep track of the money you are owed in Accounts Receivable . When customers pay those invoices, that cash shows up on your cash flow forecast in the “Cash from Accounts Receivable” row. The easiest way to think about forecasting this row is to think about what invoices will be paid by your customers and when.

2. New loans and investments in your business

You can also receive cash by getting a new loan from a bank or an investment. When you receive this kind of cash, you’ll track it in the rows for loans and investments. It’s worth keeping these two different types of cash in-flows separate from each other, mostly because loans need to be repaid while investments do not need to be repaid.

3. Sales of assets

Assets are things that your business owns, such as vehicles, equipment, or property. When you sell an asset, you’ll usually receive cash from that sale and you track that cash in the “Sales of Assets” section of your cash flow forecast. For example, if you sell a truck that your company no longer needs, the proceeds from that sale would show up in your cash flow statement.

4. Other income and sales tax

Businesses can bring in money from other sources besides sales. For example, your business may make interest income from the money that it has in a savings account. Many businesses also collect taxes from their customers in the form of sales tax, VAT, HST/GST, and other tax mechanisms. Ideally, businesses record the collection of this money not in sales but in the cash flow forecast in a specific row. You want to do this because the tax money collected isn’t yours – it’s the government’s money and you’ll eventually end up paying it to them.

Forecasting cash spent

Similar to how you forecast the cash that you plan on receiving, you’ll forecast the cash that you plan on spending in a few categories:

1. Cash spending and paying your bills

You’ll want to forecast two types of cash spending related to your business’s operations: Cash Spending and Payment of Accounts Payable. Cash spending is money that you spend when you use petty cash or pay a bill immediately. But, there are also bills that you get and then pay later. You track these bills in Accounts Payable . When you pay bills that you’ve been tracking in accounts payable, that cash payment will show up in your cash flow forecast as “payment of accounts payable”. When you’re forecasting this row, think about what bills you’ll pay and when you’ll pay them. In this section of your cash flow forecast, you exclude a few things: loan payments, asset purchases, dividends, and sales taxes.

2. Loan Payments

When you make forecast loan repayments, you’ll forecast the repayment of the principal in your cash flow forecast. The interest on the loan is tracked in the “non-operating expense” that we’ll discuss below.

3. Purchasing Assets

Similar to how you track sales of assets, you’ll forecast asset purchases in your cash flow forecast. Asset purchases are purchases of long-lasting, tangible things. Typically, vehicles, equipment, buildings, and other things that you could potentially re-sell in the future. Inventory is an asset that your business might purchase if you keep inventory on hand.

4. Other non-operating expenses and sales tax

Your business may have other expenses that are considered “non-operating” expenses. These are expenses that are not associated with running your business, such as investments that your business may make and interest that you pay on loans. In addition, you’ll forecast when you make tax payments and include those cash outflows in this section.

Forecasting cash flow and cash balance

In the direct cash flow forecasting method, calculating cash flow is simple. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. This will be your “net cash flow”. If the number is positive, you receive more cash than you spend. If the number is negative, you will be spending more cash than you receive. You can predict your cash balance by adding your net cash flow to your cash balance.

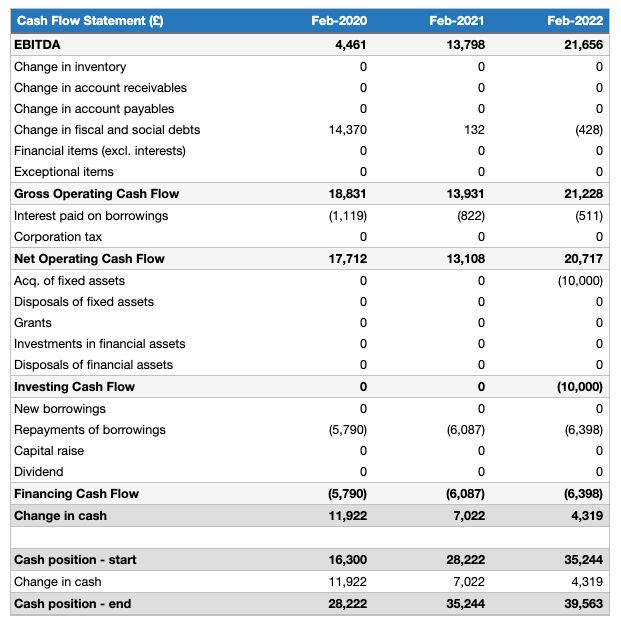

- The indirect method

The indirect method of cash flow forecasting is as valid as the direct and reaches the same results.

Where the direct method looks at sources and uses of cash, the indirect method starts with net income and adds back items like depreciation that affect your profitability but don’t affect the cash balance.

The indirect method is more popular for creating cash flow statements about the past because you can easily get the data for the report from your accounting system.

You create the indirect cash flow statement by getting your Net Income (your profits) and then adding back in things that impact profit, but not cash. You also remove things like sales that have been booked, but not paid for yet.

Here’s what an indirect cash flow statement looks like:

There are five primary categories of adjustments that you’ll make to your profit number to figure out your actual cash flow:

1. Adjust for the change in accounts receivable

Not all of your sales arrive as cash immediately. In the indirect cash flow forecast, you need to adjust your net profit to account for the fact that some of your sales didn’t end up as cash in the bank but instead increased your accounts receivable.

2. Adjust for the change in accounts payable

Very similar to how you make an adjustment for accounts receivable, you’ll need to account for expenses that you may have booked on your income statement but not actually paid yet. You’ll need to add these expenses back because you still have that cash on hand and haven’t paid the bills yet.

3. Taxes & Depreciation

On your income statement, taxes and depreciation work to reduce your profitability. On the cash flow statement, you’ll need to add back in depreciation because that number doesn’t actually impact your cash. Taxes are may have been calculated as an expense, but you may still have that money in your bank account. If that’s the case, you’ll need to add that back in as well to get an accurate forecast of your cash flow.

4. Loans and Investments

Similar to the direct method of cash flow, you’ll want to add in any additional cash you’ve received in the form of loans and investments. Make sure to also subtract any loan payments in this row.

5. Assets Purchased and Sold

If you bought or sold assets, you’ll need to add that into your cash flow calculations. This is, again, similar to the direct method of forecasting cash flow.

- Cash flow is about management

Remember: You should be able to project cash flow using competently educated guesses based on an understanding of the flow in your business of sales, sales on credit, receivables, inventory, and payables.

These are useful projections. But, real management is minding the projections every month with plan versus actual analysis so you can catch changes in time to manage them.

A good cash flow forecast will show you exactly when cash might run low in the future so you can prepare. It’s always better to plan ahead so you can set up a line of credit or secure additional investment so your business can survive periods of negative cash flow.

- Cash Flow Forecasting Tools

Forecasting cash flow is unfortunately not a simple task to accomplish on your own. You can do it with spreadsheets, but the process can be complicated and it’s easy to make mistakes.

Fortunately, there are affordable options that can make the process much easier – no spreadsheets or in-depth accounting knowledge required.

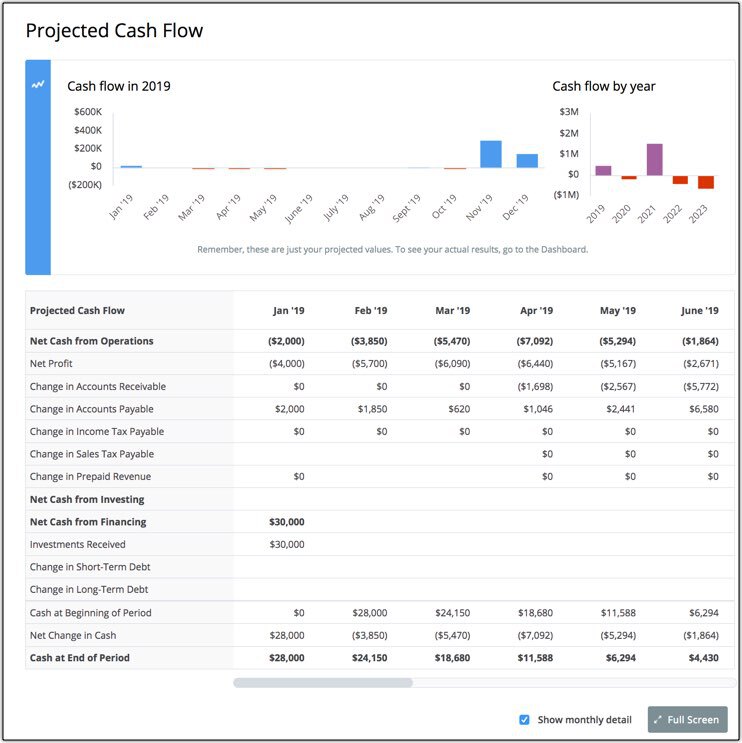

If you’re interested in checking out a cash flow forecasting tool, take a look at LivePlan for cash flow forecasting. It’s affordable and makes cash flow forecasting simple.

One of the key views in LivePlan is the cash flow assumptions view, as shown below, which highlights key cash flow assumptions in an interactive view that you can use to test the results of key assumptions:

With simple tools like this, you can explore different scenarios quickly to see how they will impact your future cash.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Profits aren’t the same as cash

Related Articles

5 Min. Read

How to Highlight Risks in Your Business Plan

8 Min. Read

How to Plan Your Exit Strategy

9 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

3 Min. Read

What Is a Break-Even Analysis?

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Example of a cashflow

- Business Finance

- Business plans and cashflow

- Back to Business plans and cashflow

- Writing your business plan

- Example of a business plan

As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year basis.

The needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will need to be bridged. Many established, viable, and even profitable businesses fail due to cash not being available when they need it most.

Good cashflow management is critical to running a successful business. You must be able to pay your bills while you await payment from your customers. There are many well-documented cases of businesses failing not because they weren't profitable but due to poor cashflow management.

You're in business to make a profit. It's a simple principle, but one that can occasionally become lost amid dreams of building multinational empires worth millions of pounds. You won't be able to stay in business, however, unless you have cash, hence the famous adage 'cash is king'.

There will probably be a time lag between your business providing its goods or services and getting paid. This means you have to make sure there is sufficient cash in your company's bank account for it to pay all its bills in the meantime – whether these relate to invoices from suppliers, employees' wages, rent, rates, tax, VAT or anything else.

Even if your business is profitable, there may be times when you are short of cash because you are awaiting payment for a large order. This is likely to be a particular problem during your first year when you are building up your business and don't have regular cash inflows.

The general principle of cashflow management is that you should speed up your cash inflows (customer payments, interest from bank accounts etc) and slow down your cash outflows within reason (purchase of stock and equipment, loan repayments and tax charges etc) as much as possible.

It can be difficult to affect your outflows other than extending your credit terms with your suppliers, which will often occur on fixed dates in the month and your employees and suppliers might also not take too kindly to you delaying payment to them. But there is more scope for you to improve your cash inflows.

This could mean billing regularly, chasing bad debt, selling your debt to a third party (factoring), negotiating extended credit terms with suppliers, managing your stock effectively (which could entail ordering little and often) and giving your customers 30-day payment terms.

Also, as businesses naturally have peaks and troughs, it is important that you put money away during the peaks so that you can dip into it during the troughs.

It is a good idea to think about investing in some accounting software to help you manage your cashflow. There are many software providers: an internet search should reveal the most common. Most provide software that can help you with cashflow analysis and forecasting, so that your business is never caught short of cash in the bank. Your accountant should be able to help advise you on which software package to buy.

How to use the cashflow forecast template

Our cashflow template will show you how a cashflow works and should be amended to suit your own business.

All figures to be entered are actual cash. This includes bank payments and receipts, cheques, bank transfers, cash payments and receipts – all of these should be included in your opening balance.

Then complete the shaded area opening balance, which includes bank, loan and cash balances and should be put in the sheets:

- monthly cashflow forecast

- monthly actual cashflow

This provides the starting point for the rest of the cashflow. Next, input your month 1 forecast – all the sales broken down into the elements of your particular business – and do the same for expenditure. Base your figures on your own experience and what you forecast to receive or pay. The sections can be amended to reflect your business's requirements.

Repeat this process for the actual cashflow; here the figures you input are based on actual. This should then automatically be displayed in the third sheet:

- monthly cashflow forecast/actual comparison

This is where the real analysis work is done and will determine the accuracy of your forecast figures. The forecasts sheet should be used to determine when you may have a cash shortfall before the event arises and will help determine whether you will need to obtain additional funding.

Download the cashflow template from 'Related documents'.

Related documents

Download EXCEL 93KB

ACCA Cashflow Template

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

- Your Future

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare a Cash Flow Statement

- 07 Dec 2021

Cash flow statements are one of the three fundamental financial statements financial leaders use. Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making. While all three are important to the assessment of a company’s finances, some business leaders might argue cash flow statements are the most important.

Business owners, managers, and company stakeholders use cash flow statements to better understand their companies’ value and overall health and guide financial decision-making. Regardless of your position, learning how to create and interpret financial statements can empower you to understand your company’s inner workings and contribute to its future success.

Related: The Beginner's Guide to Reading & Understanding Financial Statements

Here’s a look at what a cash flow statement is and how to create one.

Access your free e-book today.

What Is a Cash Flow Statement?

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period .

According to the online course Financial Accounting : “The purpose of the statement of cash flows is to provide a more detailed picture of what happened to a business’s cash during an accounting period.”

Related: How to Read & Understand a Cash Flow Statement

Since cash flow statements provide insight into different areas a business used or received cash during a specific period, they’re important financial statements when it comes to valuing a company and understanding how it operates.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

How to Create a Cash Flow Statement

1. Determine the Starting Balance

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This value can be found on the income statement of the same accounting period.

The starting cash balance is necessary when leveraging the indirect method of calculating cash flow from operating activities. However, the direct method doesn’t require this information.

2. Calculate Cash Flow from Operating Activities

One you have your starting balance, you need to calculate cash flow from operating activities. This step is crucial because it reveals how much cash a company generated from its operations.

Cash flow from operations are calculated using either the direct or indirect method.

Direct Method

The direct method of calculating cash flow from operating activities is a straightforward process that involves taking all the cash collections from operations and subtracting all the cash disbursements from operations. This approach lists all the transactions that resulted in cash paid or received during the reporting period.

Indirect Method

The indirect method of calculating cash flow from operating activities requires you to start with net income from the income statement (see step one above) and make adjustments to “undo” the impact of the accruals made during the reporting period. Some of the most common and consistent adjustments include depreciation and amortization.

Related: Financial Terminology: 20 Financial Terms to Know

Both the direct and indirect methods will result in the same number, but the process of calculating cash flow from operations differs.

While the direct method is easier to understand, it’s more time-consuming because it requires accounting for every transaction that took place during the reporting period. Most companies prefer the indirect method because it's faster and closely linked to the balance sheet. However, both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Related: GAAP vs. IFRS: What Are the Key Differences and Which Should You Use?

3. Calculate Cash Flow from Investing Activities

After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment. Keep in mind that this section only includes investing activities involving free cash, not debt.

4. Calculate Cash Flow from Financing Activity

The third section of the cash flow statement examines cash inflows and outflows related to financing activities. This includes cash flows from both debt and equity financing—cash flows associated with raising cash and paying back debts to investors and creditors.

When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP, but sometimes in the financing section under IFRS as well.

5. Determine the Ending Balance

Once cash flows generated from the three main types of business activities are accounted for, you can determine the ending balance of cash and cash equivalents at the close of the reporting period.

The change in net cash for the period is equal to the sum of cash flows from operating, investing, and financing activities. This value shows the total amount of cash a company gained or lost during the reporting period. A positive net cash flow indicates a company had more cash flowing into it than out of it, while a negative net cash flow indicates it spent more than it earned.

Cash Flow Statement Example

To help visualize each section of the cash flow statement, here’s an example of a fictional company generated using the indirect method.

Go to the alternative version .

This cash flow statement is for a reporting period that ended on Sept. 28, 2019. As you'll notice at the top of the statement, the opening balance of cash and cash equivalents was approximately $10.7 billion.

During the reporting period, operating activities generated a total of $53.7 billion. The investing activities section shows the business used a total of $33.8 billion in transactions related to investments. The financing activities section shows a total of $16.3 billion was spent on activities related to debt and equity financing.

At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the reporting period. Therefore, the final balance of cash and cash equivalents at the end of the year equals $14.3 billion.

Financial Decision-Making

Whether you’re a manager, entrepreneur, or individual contributor, understanding how to create and leverage financial statements is essential for making sound business decisions.

The statement of cash flows is one of the most important financial reports to understand because it provides detailed insights into how a company spends and makes its cash. By learning how to create and analyze cash flow statements, you can make better, more informed decisions, regardless of your position.

Are you interested in gaining a toolkit for making smarter financial decisions and the confidence to clearly communicate them to key stakeholders? Explore Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to discover how you can unlock critical insights into your organization’s performance and potential. Not sure which course is right for you? Download our free flowchart .

Data Tables

Company a - statement of cash flows (alternative version).

Year Ended September 28, 2019 (In millions)

Cash and cash equivalents, beginning of the year: $10,746

OPERATING ACTIVITIES

Investing activities, financing activities.

Increase / Decrease in Cash and Cash Equivalents: 3,513

Cash and Cash Equivalents, End of Year: $14,259

Go back to the article .

About the Author

Cash Flow Statement for Your Business Plan

Know how your money is moving..

It is a common small-business mistake to look at an income statement and conclude that a business is healthy because it is profitable. A profitable business, particularly a growing business, can still run into serious cash problems. A business that runs out of cash soon goes out of business. That’s why your business plan must include a Statement of Cash Flow.

The statement of cash flow starts by looking at the beginning cash and then makes adjustments for things that happen during the period, which impact cash. Finally, the ending cash is calculated for the month. The current month’s ending cash is next month’s starting cash. Open the sample statement of cash flow (below) and step through it from top to bottom. This example will serve as a template for your own cash flow statement.

The starting point for cash flow is the Net Ordinary Income from the income statement. From there, we’ll make adjustments to track actual inflows and outflows of cash.

Definitions

Increase / (Decrease) in Accounts Receiv able. This adjustment can seem counterintuitive at first. It is easiest to understand using the example of the first month of the new business. The income statement showed revenue of $1,000. Since the amounts were invoiced on terms of net 30, no cash has yet been received. Therefore, accounts receivable increased by $1,000.

On the sample cash flow statement, look at the January “(Increase) / Decrease in Accounts Receivable.” To reconcile net ordinary income to cash, we have to subtract $1,000. The cash flow statement has to show the change in accounts receivable from one month to the next.

In our sample financial statements, we made the assumption that 100% of the previous month’s sales will be collected in the next month, and none of the current month’s sales are collected in the current month. Assumptions such as this are reasonable taken as an average and can be used to forecast this line item of your cash flow statement.

(Increase) / Decrease in Accounts Payable. Just as we made an entry above for changes in accounts receivable, we would have a similar entry for the change in accounts payable. If our accounts payable (bills owed but not paid) increase, we would have to subtract the amount of change to reconcile cash to net operating income. Most new, small businesses are required to pay their bills in the current month. As such, accounts payable stay at approximately $0. All bills are paid at the end of the month. With no change from month to month, no cash flow adjustment is necessary.

Let’s continue with the other adjustments, which are more straightforward.

Deposits and Prepaid Expenses . A deposit or prepaid expense doesn’t show up on the income statement because it is not a current expense. Yet it takes away from cash in the bank. When our sample business signed an office lease, it had to provide a security deposit of $2,000 in February. This isn’t “rent,” it’s a deposit. You’ll see this number again when we talk about the balance sheet. But for now, we need to subtract this amount, $2,000, in February to further reconcile net operating income to cash. You’ll see this entry in February of our sample statement of cash flow under Deposits and Prepaid Expenses.

Capital Purchases. For an understanding of how capital purchases and depreciation work together, read the capital purchases section and the depreciation section together (see below).

When you purchase a piece of equipment, the impact on cash is immediate. However, the full expense only shows up on the income statement over a longer period of time. So once again, we have to make an adjustment to reconcile net operating income to cash. This is a two-part exercise. First we take into account the purchase and then the “depreciation,” which is highlighted below.

To account for the purchase price of the asset, we make an entry for the full cost on the statement of cash flow in the Capital Purchases line. In our sample financials, you’ll see that the business made furniture, equipment or other capital purchases of $12,000 in January, $5,000 in March and $3,000 in August. These are shown as negative numbers because they take away from cash.

Depreciation. When you purchase an asset such as a piece of equipment with a useful life greater than the current year, the government requires the asset to be written off over a longer period of time. You can’t simply create an expense for the full amount in the current period. Why does the government care? They don’t want businesses making large purchases just to reduce taxes. The rules governing depreciation are complex and vary by the type of asset. Here we’re addressing only how depreciation affects cash flow.

In our sample company, our “sample accountant” has calculated a depreciation schedule for each type of asset and told us to spread out depreciation expense evenly over the course of the year at $1,000 per month. On the income statement, this keeps the expense even instead of creating a big hit in a single month. However, this depreciation isn’t a cash expense, it’s just a write-off against taxable income. On the cash flow statement, we have to add back depreciation to reconcile cash to net operating income. See the sample statement of cash flow where we’ve added back $1,000 in each month.

Net Cash from Operations. The sum of the net operating income and the adjustments to reconcile to cash (detailed above) equal the net cash from operations. This is a subtotal on our way to showing the month-ending cash balance.

Financing Activities. Since financing activities (all loans and capital investments) impact the cash flow statement much in the same way, we’ll cover them all in this same paragraph. Each time you receive money for a loan or capital investment (whether by an owner or investor) the proceeds need to show up on your statement of cash flow. Money or “cash” comes into the business and it needs to be accounted for.

While interest on a loan is an expense and therefore found on the income statement, principal repayment is not categorized as an expense. Therefore, to reconcile the income statement to cash, we have to show these repayments on the statement of cash flow. Loan repayments take away from cash and are therefore shown as a negative number on the cash flow statement.

On the sample statement of cash flow, you can see that the business received loan proceeds of $40,000 in January, plus an investment from the owner (Capital Stock) of $15,000 also in January. Then, the company repaid $1,000 in principal each month of the year. These monthly repayments reduce cash.

Net Cash Increase / (Decrease). Continuing down the Statement of Cash Flow, the Net increase / (Decrease) in Cash is the fully reconciled change in cash for the period. In other words, it takes into account net ordinary income, adjustments for changes in accounts receivable, deposits and prepaid expenses, capital purchases and depreciation. Next, the adjustments for financing activities are accounted for as described above. The sum of the net ordinary income and all of the adjustments is the net increase or decrease in cash.

Beginning and Ending Cash. In the sample financial statements, the Ending Cash for January is $37,175. Notice that the Beginning Cash for February is the same amount, $37,175. Beginning Cash for any period is simply the ending cash for the prior period.

To calculate the Ending Cash, you add the Net Cash Increase or Decrease to the Beginning Cash. In other words, take what you started with, take into account the change in the period, and what you have left is the ending cash. In our sample financials, in January the business started with nothing (since that’s the month the business was started), and the Net Increase in Cash was $37,175. Therefore the Ending Cash for January was $37,175, or $0 + $37,175. As you can see, the business took out a loan, received a capital investment from the founder, made some capital purchases, and had a net ordinary loss.

Want a great business plan template you can complete in just one day?

Sba microloans for small business and startups, business plan elevator pitch, the best small business plan templates, business plan help, what you must know before buying a business.

The Plain-English Guide to Cash Flow Statement

Published: September 20, 2018

Do you know where your business’ money is going? If not, it’s time to investigate. Many small business owners do their own accounting, either with accounting software or manually, with a spreadsheet.

In financial accounting, the cash flow statement, or statement of cash flows, will show where your business’ revenue is coming from and where it’s going. It’s one of the main financial statements used in accounting to provide an overview of business results -- along with the balance sheet, income statement, and statement of stockholders' equity.

But what does the statement of cash flows include? And how is it prepared? We’ll dig into the ins and outs of the cash flow statement below, so you can determine your business’ cash flow and if you can afford that fancy espresso machine for the company break room.

What is Cash Flow?

Cash flow is the net amount of money moving in and out of a business. It shows where cash comes from and how it’s being used.

A positive cash flow means your cash inflows were greater than your cash outflows. If the cash flow is negative, the business might not have enough cash to finance operations. This could mean the business is financing operations by borrowing.

So, how do we determine the cash flow? A statement of cash flows, of course.

What is a Statement of Cash Flows?

A statement of cash flows studies operating, financing, and investing activities to show where your business’ money is coming from and where it’s being spent. It allows investors and creditors to assess a business' ability to meet obligations and produce future net cash inflows while determining the need for external financing.

There are two methods for determining cash flow: direct and indirect. Both methods look at cash flow over an accounting period, which is typically 12 months.

The direct method is used less often and requires more information than the indirect method. It lists cash inflows and outflows for every type of operating activity, including:

- Cash collected from customers

- Employee salaries

- Interest and dividends received

- Cash paid to suppliers or vendors

- Interest paid

- Income tax paid

The Financial Accounting Standards Board (FASB) prefers the direct method over the indirect method, because the direct method provides a more detailed view of the operating cash inflows and outflows of a business. And it can give decision makers and potential investors a more accurate picture of how a business is doing.

The indirect method is the most popular way to create a statement of cash flows. It starts by looking at the net income from the income statement . And it’s broken down into three main parts:

- Operating activities include revenue and operating expenses. They are only included if the cash payment occurred during the account period the statement reports on.

- Investing activities include purchasing property, a manufacturing plant, or equipment. They might also include the acquisition of a business.

- Financing activities include issuing shares, selling or repurchasing stock, and paying debt and dividends.

Let’s take a look at the steps you should take to prepare a statement of cash flows using the indirect method.

How to Prepare a Statement of Cash Flows

- Calculate net cash flow from operating activities.

- Calculate net cash flow from investing activities.

- Calculate net cash flow from financing activities.

- Combine net cash flows from operating, investing, and financing activities.

Once the net cash flows from operating, investing and financing activities are calculated and combined, you’ll see the net cash increase or decrease for the period. This confirms the net of these changes is equal to the change in cash on the balance sheet .

Operating Cash Flow

Operating cash flow (OCF or CFO) is the first portion of the statement of cash flows. And it determines the revenue-generating aspects of the business. The formula for calculating operating cash flow is:

Operating Cash Flow (OCF) = Total Revenue - Operating Expenses

For a business to be successful, long-term cash inflows must be greater than outflows. If outflows are greater than inflows, the business will likely need external financing .

Free Cash Flow

A company’s free cash flow is the cash they generate minus the cost of expenditures on assets. Below is the formula for calculating free cash flow:

Free cash flow = Net cash flow from operating activities - Capital expenditures

This gives you the remaining cash amount after your business pays for operating expenses and capital expenditures. The calculation is important because it shows if a business has enough cash left over to pay back investors.

Discounted Cash Flow

Discounted cash flow (DCF) is a method used to evaluate a potential investment opportunity. The discounted cash flow can be used to value a:

- Project or initiative

- Company’s shares

The result shows how much return you can expect to earn from the investment. Here’s how to calculate discounted cash flow:

DCF = [CF1 / (1+r)1] + [CF2 / (1+r)2] + ... + [CFn / (1+r)n]

CF = cash flow in the period

n = the period number (years, quarters, or months)

r = discount rate or WACC (i.e., the rate a business expects to pay for its assets)

The DCF takes into account the time value of money -- the concept that a dollar today is worth more than a dollar tomorrow due to its earning potential (e.g., interest rate).

If you pay more than the DCF value, the return will be less than the discount rate. And if you pay less than the DCF value, the return will be greater than the discount rate. When the DCF value is higher than the cost of the potential investment, it’s likely a good one.

Whether you’re determining where your money is coming from and where it’s going or looking for investors and financing -- the cash flows allow you to see how cash is moving in and out of a business. With the information provided by the statement of cash flows, you’ll be well-prepared to make informed decisions about the future of your business .

Don't forget to share this post!

Related articles.

70 Small Business Ideas for Anyone Who Wants to Run Their Own Business

![cash flow business plan example How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hubfs/How-to-Start-a-Business-Aug-11-2023-10-39-02-4844-PM.jpg)

How to Start a Business: A Startup Guide for Entrepreneurs [Template]

Door-to-Door Sales: The Complete Guide

Amazon Affiliate Program: How to Become an Amazon Associate to Boost Income

![cash flow business plan example How to Write a Business Proposal [Examples + Template]](https://blog.hubspot.com/hubfs/how-to-write-business-proposal%20%281%29.webp)

How to Write a Business Proposal [Examples + Template]

Product Differentiation and What it Means for Your Brand

The 25 Best PayPal Alternatives of 2023

The First-Mover Advantage, Explained

Intrapreneurship vs. Entrepreneurship: What's the Difference?

P&L Statement, Cash Flow Statement, Balance Sheet, and more.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Free Cash Flow Forecast Templates

By Andy Marker | June 24, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free cash flow forecast templates, including those for small businesses, nonprofits, and personal cash flow forecasting, as well tips for performing a cash flow forecast.

Included on this page, you'll find a simple cash flow forecast template and a small business cash flow projection template , as well as the benefits of cash flow forecasting .

What Is a Cash Flow Forecast Template?

A cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. The template provides a way to examine day-by-day, month-by-month, quarter-by-quarter, or year-over-year projected cash receipts and cash payments as compared to your operating expenses and other outflows.

Use the preset criteria in a template to take the guesswork out of cash flow forecast requirements. You can then use the forecast to provide your company (or third parties) with a clear picture of your projected business costs. While cash flow forecasting allows you to look at projected cash flow, you can also track the actual cash flow for any chosen time period (i.e., daily, weekly, monthly, quarterly, or yearly).

To learn more about cash flow forecasting and to view examples, visit " How to Create a Cash Flow Forecast, with Templates and Examples ."

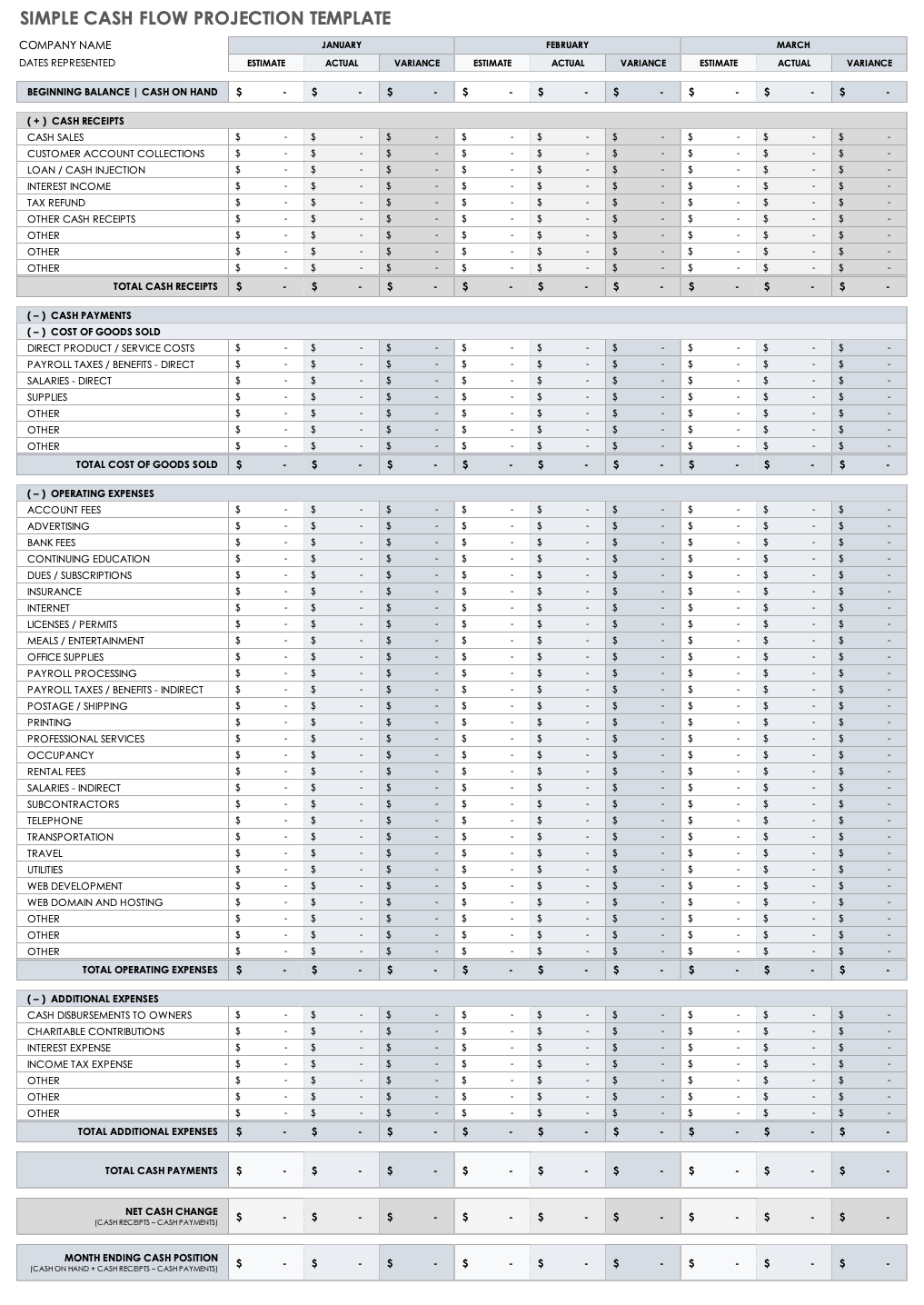

Simple Cash Flow Forecast Template

Use this basic template to gain monthly insight into your company’s cash flow and ensure you have sufficient funds to continue operating. Fill in your information for beginning balance (cash on hand), cash receipts and disbursements (R&D), operating expenses, and additional expenses. The template will auto-tally the monthly net cash change and month ending cash position columns. Use this information to forecast how long your cash will last, and whether you need to obtain additional financing.

Download Simple Cash Flow Projection Template - Excel

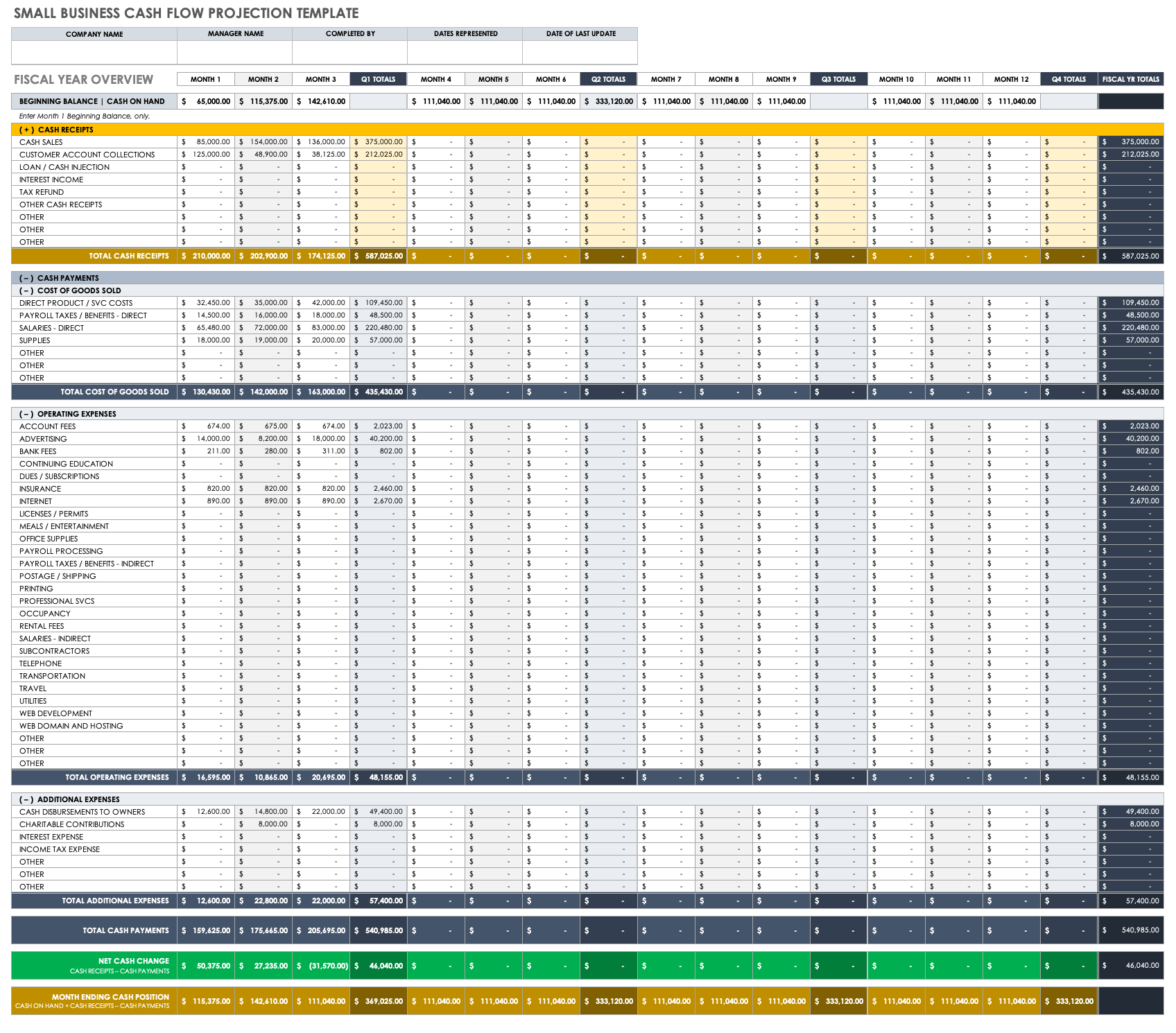

Small Business Cash Flow Projection Template

Use this cash flow projection template, designed for small businesses, to determine whether or not your business has adequate cash to meet its obligations. The monthly columns provide a big picture of how long funds should last, and the tallies for cash receipts, cash paid out, and other operating figures allow you to identify any potential shortfalls of your cash balances. This small business cash flow template also works with projected figures for a small business plan.

Download Small Business Cash Flow Projection Template - Excel

12-Month Cash Flow Forecast Template

Track your company’s overall cash flow with this easily fillable 12-month cash flow forecast template. This template includes unique expected and actual cash-on-hand details for the beginning of each month, which you can use to ensure that you can pay all employees and suppliers. Enter cash receipts and cash paid out figures to determine your end-of-month cash position. The monthly details of this forecast template allow you to track — at a glance — any threats to your company’s cash flow.

Download 12-Month Cash Flow Forecast Template

Excel | Smartsheet

Cash Flow Forecast Template

This simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your company’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing.

Download Cash Flow Forecast Template - Excel

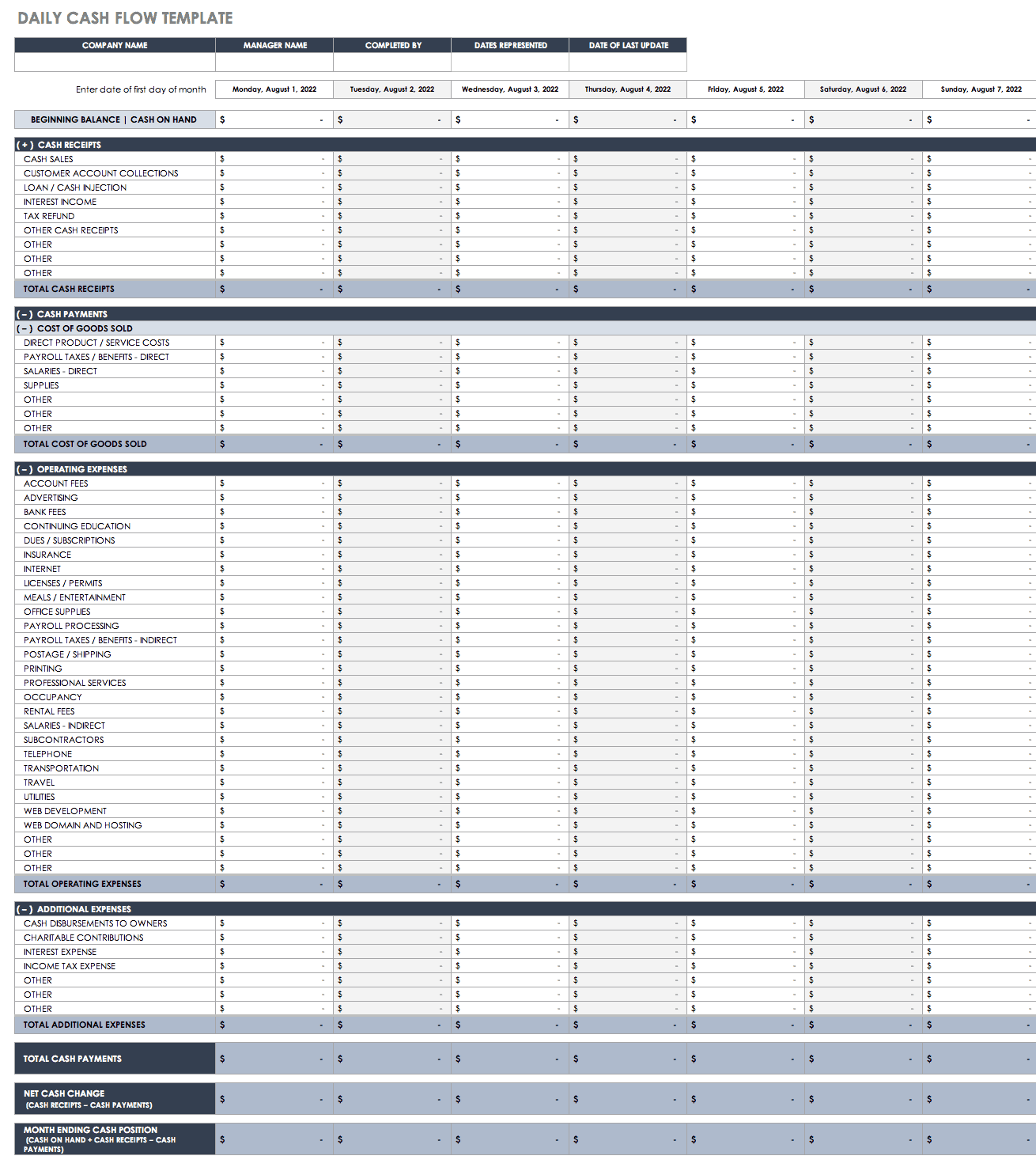

Daily Cash Flow Forecast Template

Use this daily cash flow forecast template to get a pulse on your business’ short-term liquidity. Daily cash flow forecasts are particularly helpful in determining that everything is accounted for and for avoiding any shortfalls. The template calculates cash payments against operating expenses to provide a daily net cash change and month-ending cash positions. This template has everything you need to get a day-by-day perspective of your business’s financial performance and outlook.

Download Daily Cash Flow Forecast Template

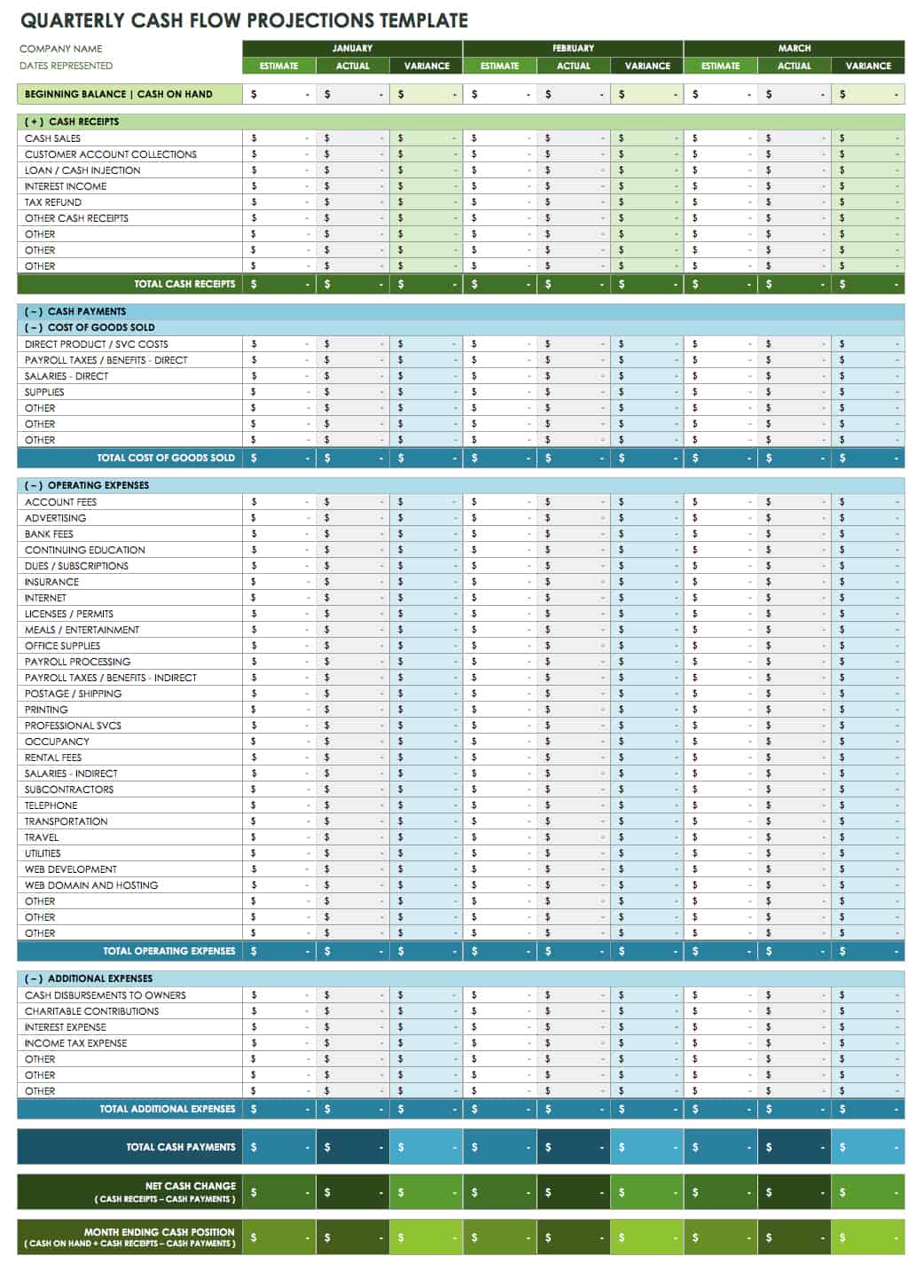

Quarterly Cash Flow Projections Template

Keep quarterly tabs on your cash flow with this customizable template. Use the quarter-by-quarter tabs to quickly detect any problems with a variety of factors, such as late customer payments and their potential impact on your business. This quarterly cash flow projections template is perfect for determining how any given variable might affect future financial planning.

Download Quarterly Cash Flow Projections Template

Excel | Smartsheet

Three-Year Cash Flow Forecast Template

Get the big picture of your company’s long-term cash flow with this three-year cash flow forecast template. The spreadsheet provides separate tabs for a current cash flow statement, as well as 12-month cash flow and three-year cash flow projections. Enter year-by-year operations, investing activities, and financing details to see your year-over-year net increases or decreases. You can save this template as an individual file with customized entries, or share it with other business units or departments that need to provide cash flow details.

Download Three-Year Cash Flow Forecast Template

Discounted Cash Flow Forecast Template

Designed around the concept of discounted cash flow (DCF) valuation based on future cash flows, this template allows you to perform an analysis to determine your business’ true value. You’ll find year-by-year rows, their respective incomes (cash inflow), expenses (fixed and variable), cash outflow, net cash, and DCF details (present value and cumulative present value), and actual present value, all of which culminates in net present value. This DCF forecast template is also ideal for determining the value of a potential investment.

Download Discounted Cash Flow Template

Excel | Smartsheet

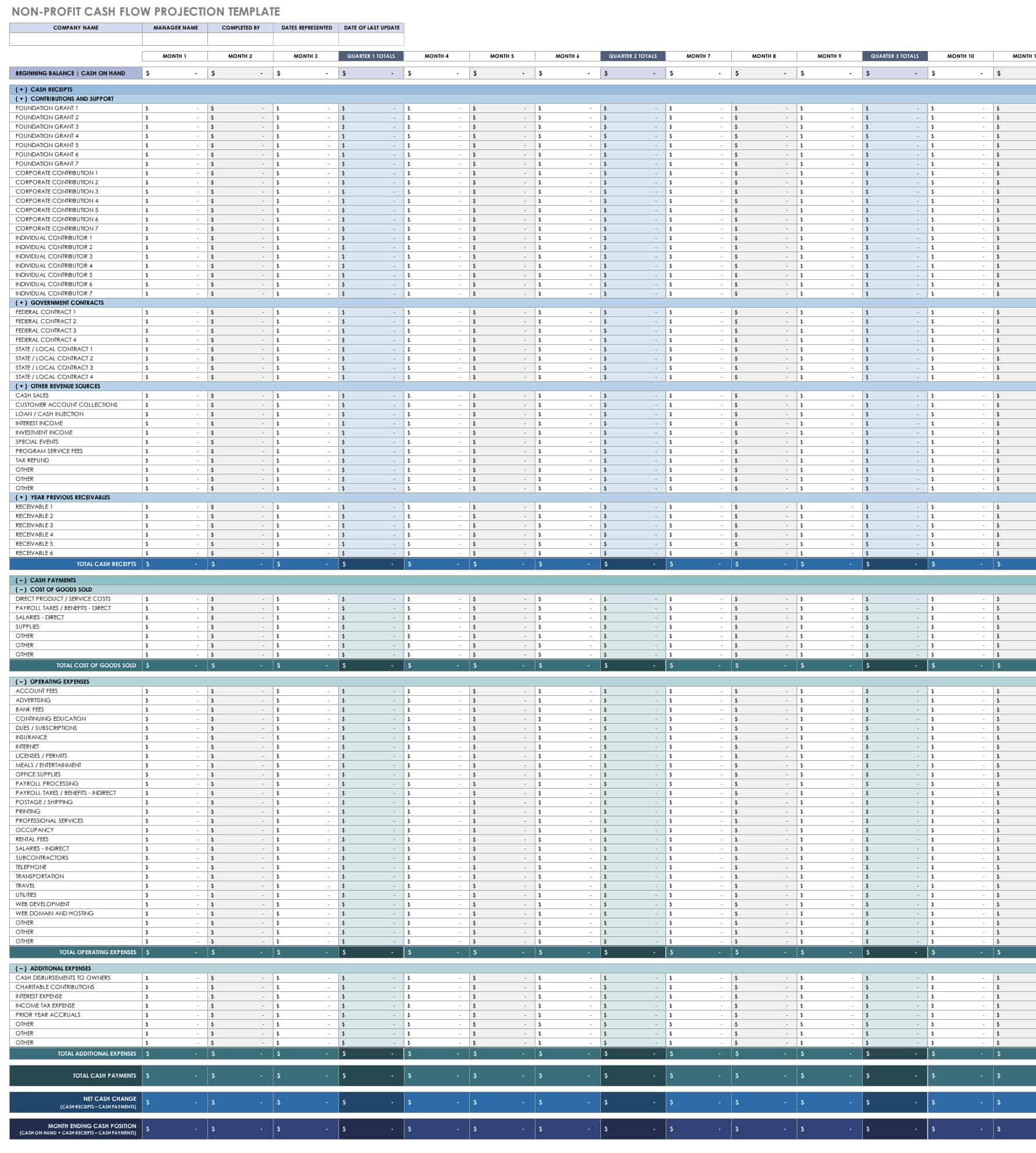

Nonprofit Cash Flow Projection Template

Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. There are sections for cash receipts, contributions and support, government contracts, other revenue sources, and receivables from previous years. This template is completely customizable, and provides insight into monthly and yearly carryover, so you can keep tabs on your rolling cash balance.

Download Nonprofit Cash Flow Projection Template

Personal Cash Flow Forecast Template

Manage your financial outlook with this personal cash flow forecast template. Compare your personal income to your expenses, with the additional factor of savings. The automatic pie chart provides insight into whether you’re spending above your means. Enter your income, savings, and expense data to get a comprehensive picture of your short and long-term cash flow.

Download Personal Cash Flow Forecast Template

Creating a Cash Flow Forecast

In order to set yourself up for success, you must be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received, or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: This refers to the closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, as well as any upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

The Benefits of Cash Flow Forecasting

Regardless of the reporting period, or granularity , you choose for your cash flow forecast, you should take into account important cash flow forecast-specific factors, such as seasonal trends, to gain a clear picture of your company’s finances. Accurate cash flow forecasting can enable you to do the following:

- Anticipate any cash-balance shortfalls.

- Verify that you have enough cash on hand to pay suppliers and employees.

- Call attention to customers not paying on time, and eliminate cash flow discrepancies.

- Act proactively, in the event that cash flow issues will adversely affect budgets.

- Notify stakeholders, such as banks, who might require such forecasting for loans.

Tips for Improving Cash Flow Forecasting

Whether you are a large or small business and want a day-by-day or three-year picture of your company’s projected cash flow,keep the following tips in mind:

- Pick the Right Cash Flow Forecasting Template: There are templates available for a variety of forecasting needs, including those for organization size and one that provides short or long-term insights. Select a template that’s suitable to your particular cash flow forecasting needs.

- Use a Discounted Cash Flow (DCF) Template: If you are looking to estimate the current value of your company, based on the time value of money (the benefit of receiving cash infusions sooner than later), you’ll want to do a DCF.

- Enter Variables Accurately: Inflows and outflows can change on a literal dime. Ensure that you tally all beginning balances (cash on hand), cash receipts and disbursements (R&D), and operating expenses correctly. These numbers provide the big-picture net cash change and your ultimate cash position.

- Choose the Right Forecasting Horizon: The margin of error when using a three-year cash flow forecasting template is greater than performing a daily cash flow forecast. When choosing a template, keep in mind the time-period for the forecast.

- Consider Seasonal Fluctuations: If your cash flow fluctuates by season (tax, interest, larger annual payments, etc.), incorporate those details into your cash flow forecast. This will ensure that one quarter’s inflow doesn’t positively or negatively affect another in your forecast.

Discover a Better Way to Manage Cash Flow Forecasts and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Business Plan Cash Flow Template

Identify the operating period, establish sales forecast for the period, calculate cost of goods sold, determine gross profit, identify expected operating expenses.

- 2 Utilities

- 4 Marketing

- 5 Insurance

Calculate net income before taxes

Estimate income tax expense, calculate net income, adjust for non-cash expenses, approval: cash flow calculations.

- Calculate net income before taxes Will be submitted

- Estimate income tax expense Will be submitted

- Calculate net income Will be submitted

- Adjust for non-cash expenses Will be submitted

Determine changes in working capital

Calculate cash flow from operating activities, identify investing activities, calculate cash flow from investing activities, identify financing activities, calculate cash flow from financing activities, reconcile beginning and ending cash balances, approval: final business plan cash flow template.

- Calculate cash flow from operating activities Will be submitted

- Calculate cash flow from investing activities Will be submitted

- Calculate cash flow from financing activities Will be submitted

- Reconcile beginning and ending cash balances Will be submitted

Take control of your workflows today.

More templates like this.

- Cash Flow Projection – The Comple...

Cash Flow Projection – The Complete Guide

Table of Content

Key takeaways.

- Cash flow projection is a vital tool for financial decision-making, providing a clear view of future cash movements.

- Cash flow is crucial for business survival and includes managing cash effectively and providing a financial planning roadmap.

- Automation in cash flow management is a game-changer. It enhances accuracy, efficiency, and scalability in projecting cash flows, helping businesses avoid common pitfalls.

Introduction

Cash flow is the lifeblood of any business. Yet, many companies constantly face the looming threat of cash shortages, often leading to their downfall. Despite its paramount importance, cash flow management can be overwhelming, leaving businesses uncertain about their financial stability.

But fear not, there’s a straightforward solution to this common problem – cash flow projection. By mastering the art of cash flow projection, you can gain better control over your finances and steer your business away from potential financial crises. Cash flow projections offer a proactive approach to managing cash flow, enabling you to anticipate challenges and make informed decisions to safeguard the future of your business.

If you’re unsure how to accurately perform cash flow projections or if you’re new to the concept altogether, this article will explain everything you need to know about cash flow projections – to help you confidently navigate the financial landscape of your business.

What Is Cash Flow?

To grasp the concept of cash flow projections, we must first understand the essence of cash flow itself. Cash flow is all about the movement of money flowing in and out of business. It reflects the company’s financial health and liquidity, capturing the inflows and outflows of cash over a specific timeframe.

To truly grasp your business’s financial landscape, you must understand the stages of cash flow: operating, investing, and financing activities, and how to analyze and make sense of it.

Read more to uncover a step-by-step guide on how to perform a cash flow analysis (template + examples) and methods to assess key items in cash flow statements.

What Is Cash Flow Projection?

Cash flow projection is the process of estimating and predicting future cash inflows and outflows within a defined period—usually monthly, quarterly, or annually.

Think of cash flow projection (also referred to as a cash flow forecast) as a financial crystal ball that allows you to peek into the future of your business’s cash movements. It involves mapping out the expected cash inflows (receivables) from sales, investments, and financing activities and the anticipated cash outflows (payables) for expenses, investments, and debt repayments.

It provides invaluable foresight into your business’s anticipated cash position, helping you plan for potential shortfalls, identify surplus funds, and make informed financial decisions.

Why Are Cash Flow Projections Important for Your Business?

Managing cash flow is a critical aspect of running a successful business. It can be the determining factor between flourishing and filing for Chapter 11 (aka bankruptcy ).

In fact, studies reveal that 30% of business failures stem from running out of money. To avoid such a fate, by understanding and predicting the inflow and outflow of cash, businesses can make informed decisions, plan effectively, and steer clear of potential financial disasters.

Cash Flow Projection vs. Cash Flow Forecast

Having control over your cash flow is the key to a successful business. By understanding the differences between cash flow statements and projections, small business owners can use these tools more effectively to manage their finances and plan for the future.

Discover the power of HighRadius cash flow forecasting software ,designed to precisely capture and analyze diverse scenarios , seamlessly integrating them into your cash forecasts. By visualizing the impact of these scenarios on your cash flows in real time, you gain a comprehensive understanding of potential outcomes and can proactively respond to changing circumstances.

Here’s how AI takes variance analysis to the next level and helps you generate accurate cash flow forecasts with low variance. It automates the collection of data on past cash flows, including bank statements, accounts receivable, accounts payable, and other financial transactions, and integrates with most financial systems. This data is analyzed to detect patterns and trends that can be used to anticipate future cash flows. Based on this historical analysis and regression analysis of complex cash flow categories such as A/R and A/P, AI selects an algorithm that can provide an accurate cash forecast.

Step-by-Step Guide to Creating a Cash Flow Projection

Step 1: choose the type of projection model.

- Determine the appropriate projection model based on your business needs and planning horizon.

- Consider the following factors when choosing a projection model:

- Short-term Projections: Covering a period of 3-12 months, these projections are suitable for immediate planning and monitoring.

- Long-term Projections: Extending beyond 12 months, these projections provide insights for strategic decision-making and future planning.

- Combination Approach: Use a combination of short-term and long-term projections to address both immediate and long-range goals.

Step 2: Gather historical data and sales information

- Want to determine where you’re going? Take a look at where you’ve already been. Collect relevant historical financial data, including cash inflows and outflows from previous periods.

- Analyze sales information, considering seasonality, customer payment patterns, and market trends.

Pro Tip: Finance teams often utilize accounting software to ingest a range of historical and transactional data. Read on to discover the business use cases of implementing a treasury management solution for optimal cash flow management .

Step 3: Project cash inflows

- Estimate cash inflows based on sales forecasts, considering factors such as payment terms and collection periods.

- Utilize historical data and market insights to refine your projections.

Step 4: Estimate cash outflows

- Identify and categorize various cash outflows components, such as operating expenses, loan repayments, supplier payments, and taxes.

- Use historical data and expense forecasts to estimate the timing and amount of cash outflows.

Pro Tip: By referencing the cash flow statement, you can identify the sources of cash inflows and outflows. Learn more about analyzing projected cash flow statement .

Step 5: Calculate opening and closing balances

- Calculate the opening balance for each period, which represents the cash available at the beginning of the period.

- Opening Balance = Previous Closing Balance

- Calculate the closing balance by considering the opening balance, cash inflows, and cash outflows for the period.

- Closing Balance = Opening Balance + Cash Inflows – Cash Outflows

Step 6: Account for timing and payment terms

- Consider the timing of cash inflows and outflows to create a realistic cash flow timeline.

- Account for payment terms with customers and suppliers to align projections with cash movements.

Step 7: Calculate net cash flow

- Calculate the net cash flow for each period, which represents the difference between cash inflows and cash outflows.

- Net Cash Flow = Cash Inflows – Cash Outflows

Pro Tip: Calculating the net cash flow for each period is vital for your business as it gives you a clear picture of your future cash position. Think of it as your future cash flow calculation.

Step 8: Build contingency plans

- Incorporate contingency plans to mitigate unexpected events impacting cash flow, such as economic downturns or late payments.

- Create buffers in your projections to handle unforeseen circumstances.

Step 9: Implement rolling forecasts

- Embrace a rolling forecast approach, where you regularly update and refine your cash flow projections based on actual performance and changing circumstances.

- Rolling forecasts provide a dynamic view of your cash flow, allowing for adjustments and increased accuracy.

Cash Flow Projection Example

Let’s take a sneak peek into the cash flow projection of Pizza Planet, a hypothetical firm. In March, they begin with an opening balance of $50,000. This snapshot will show us how their finances evolved during the next 4 months.

Here are 5 key takeaways from the above cash flow projection analysis for Pizza Planet:

Upsurge in Cash Flow from Receivables Collection (April):

- Successful efforts in collecting outstanding customer payments result in a significant increase in cash flow.

- Indicates effective accounts receivable management and timely collection processes.

Buffer Cash Addition (May and June):

- The company proactively adds buffer cash to prepare for potential financial disruptions.

- Demonstrates a prudent approach to financial planning and readiness for unexpected challenges.

Spike in Cash Outflow from Loan Payment (May):

- A noticeable cash outflow increase is attributed to the repayment of borrowed funds.

- Suggests a commitment to honoring loan obligations and maintaining a healthy financial standing.

Manageable Negative Net Cash Flow (May and June):

- A negative net cash flow during these months is offset by positive net cash flow in other months.

- Indicates the ability to handle short-term cash fluctuations and maintain overall financial stability.

Consistent Closing Balance Growth:

- The closing balance exhibits a consistent and upward trend over the projection period.

- Reflects effective cash flow management, where inflows cover outflows and support the growth of the closing cash position.

How to Calculate Projected Cash Flow?

To calculate projected cash flow, start by estimating incoming cash from sources like sales, investments, and financing. Then, deduct anticipated cash outflows such as operating expenses, loan payments, taxes, and capital expenditures. The resulting net cash flow clearly shows how much cash the business expects to generate or use within the forecasted period.

Calculating projected cash flow is a crucial process for businesses to anticipate their future financial health and make informed decisions. This process involves forecasting expected cash inflows and outflows over a specific period using historical data, sales forecasts, expense projections, and other relevant information. Regularly updating and reviewing projected cash flow helps businesses identify potential cash shortages or surpluses, allowing for proactive cash management strategies and financial planning.

Benjamin Franklin once said, ‘Beware of little expenses; a small leak will sink a great ship.’ This underscores the importance of managing and understanding cash flow in business.

Download this cash flow calculator to effortlessly track your company’s operating cash flow, net cash flow (in/out), projected cash flow, and closing balance.

6 Common Pitfalls to Avoid When Creating Cash Flow Projections

At HighRadius, we recently turned our research engine toward cash flow forecasting to shed light on the sources of projection failures. One of our significant findings was that most companies opt for unrealistic projections models that don’t mirror the actual workings of your finance force.

Cash flow projections are only as strong as the numbers behind them. No one can be completely certain months in advance if literal or figurative storm clouds are waiting for them on the horizon. Defining a realistic cash flow projection for your company is crucial to achieving more accurate results. Don’t let optimism cloud your key assumptions. Stick to the most likely numbers for your projections.

A 5% variance is acceptable, but exceeding this threshold warrants a closer look at your key assumptions. Identify any logical flaws that may compromise accuracy. Take note of these pitfall insights we’ve gathered from finance executives who have shared their experiences:

- Avoid overly generous sales forecasts that can undermine projection accuracy.

- Maintain a realistic approach to sales projections to ensure reliable cash flow projections.

- Reflect the payment behavior of your customers accurately in projections, especially if they tend to pay on the last possible day despite a 30-day payment schedule.

- Adjust the projection cycle to align with the actual payment patterns.

- Factor in annual and quarterly bills on the payables side of your projections.

- Consider potential changes in tax rates if your business is expected to reach a new tax level.

- Account for seasonal fluctuations and cyclical trends specific to your industry.

- Analyze historical data to identify patterns and adjust projections accordingly to reflect these variations.

- Incorporate contingencies in your projections to prepare for unforeseen circumstances such as economic downturns, natural disasters, or changes in market conditions.

- Build buffers to mitigate the impact of unexpected events on your cash flow.

- Failing to create multiple scenarios can leave you unprepared for different business outcomes.

- Develop projections for best-case, worst-case, and moderate scenarios to assess the impact of various circumstances on cash flow.

By addressing these pitfalls and adopting best practices shared by finance executives, you can create more reliable and effective cash flow projections for your business. Stay proactive and keep your projections aligned with the realities of your industry and market conditions.

How Automation Helps in Projecting Cash Flow?

Building a cash flow projection chart is just the first step; the real power lies in the insights it can provide. Cash flow projection is crucial, but let’s face it – the traditional process is resource-consuming and hampers productivity. Finance teams have no choice but to abandon it and let it gather dust for the remainder of a month.

However, there’s a solution: a cash flow projection automation tool.

Professionals in Controlling or Treasury understand this need for automation, but it requires an investment of time and money. Building a compelling business case is straightforward, especially for companies prioritizing cash reporting, forecasting, and leveraging the output for day-to-day cash management and investment planning.

Consider the following 3 business use cases shared by finance executives, highlighting the benefits that outweigh the initial investment:

Scalability and adaptability:

Forecasting cash flow in spreadsheets is manageable in the early stages, but as your business grows, it becomes challenging and resource-intensive. Manual cash flow management struggles to keep up with the increasing transactions and customer portfolios.

Many businesses rely on one-off solutions that only temporarily patch up cash flow processes without considering the implications for the future. Your business needs an automation tool that can effortlessly scale with your business, accommodating evolving needs.

Moreover, such dependable partners often offer customization options, allowing you to tailor the cash flow projections to your specific business requirements and adapt to changing market dynamics.

Time savings:

Consider a simple example of the time and effort involved in compiling a 13-week cash flow projection for stakeholders every week. The process typically includes

- Capture cash flow data from banking and accounting platforms and classify transactions.

- Create short-term forecasts using payables and receivables data.

- Model budget and other business plans for medium-term forecasts.

- Collect data from various business units, subsidiaries, and inventory levels.

- Consolidate the data into a single cash flow projection.

- Perform variance and sensitivity analysis.

- Compile reporting with commentary.

This process alone can consume many hours each week. Let’s assume it takes six hours for a single resource and another six hours for other contributors, totaling 12 hours per week or 624 hours per year. Whether you are an enterprise or an SMB, learn how a 13-week cash flow projection template can help you keep your business on track and achieve your financial goals.

Imagine the added time spent on data conversations, information requests, and follow-ups. Cash reporting can quickly become an ongoing, never-ending process.

By implementing a cash flow projection automation tool, you can say goodbye to tedious manual tasks such as logging in, downloading data, manipulating spreadsheets, and compiling reports. Automating these processes saves your team countless hours, allowing them to focus on strategic initiatives and high-value activities.

Accuracy and efficiency:

When it comes to cash flow monitoring and projection, accuracy is paramount for effective risk management. However, manual data handling introduces the risk of human error, which can have significant financial implications for businesses. These challenges may include:

- Inaccurate financial decision-making